Lumpsum

Maximize Wealth with One-Time Investments

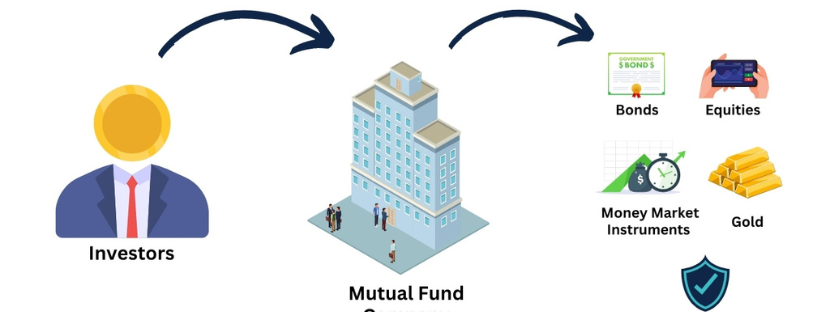

At Kaundinya Tradings, we provide expert solutions for investors who prefer to make one-time investments through Lumpsum in mutual funds. Whether you’re planning for long-term wealth creation or achieving specific financial goals, Lumpsum investing offers a straightforward and efficient way to grow your portfolio.

Why Choose Us

Expert Guidance

Top Fund Options

Portfolio Analysis

Transparent Processes

Dedicated Support

How does lumpsum investment differ from SIPs?

Lumpsum involves a one-time investment, while SIPs (Systematic Investment Plans) are periodic contributions. Both cater to different investment styles and goals.

What is the ideal time to invest lumpsum?

The ideal time depends on market conditions and your financial objectives. Long-term investors benefit regardless of market fluctuations.

Are lumpsum investments risky?

Like all mutual fund investments, lumpsum investments carry market risks. Diversified and long-term investments can mitigate these risks.

What is the lock-in period for lumpsum investments?

It depends on the fund type. For example, ELSS funds have a 3-year lock-in period, while others may not have any.

Benefits of Lumpsum Investment

1

Compounding Returns

Earn returns on both the principal and accrued gains.

3

Flexibility

Suitable for varying investment horizons and risk profiles.

2

Ease of Investing

Simple process with no recurring commitments.

4

Wealth Growth

One-time investments benefit from market appreciation over the long term.

Start your lumpsum investment journey today with Kaundinya Tradings and secure a prosperous future!